a personal history, a necessary future

By Adam Seitchik

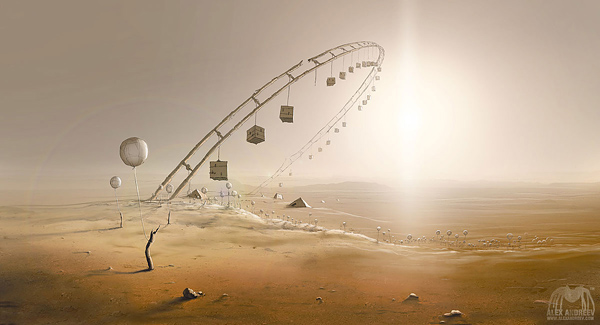

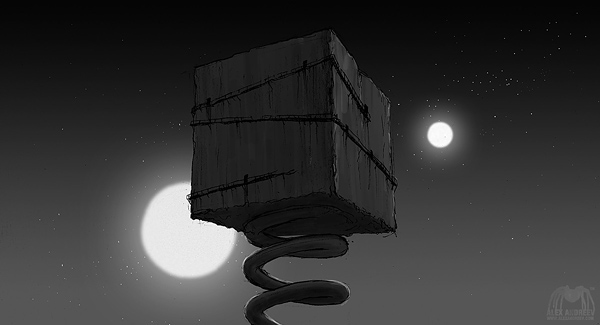

Visuals: Alex Andreev

February 29, 2016

I think it can be, but only if several things happen.

Economists from Adam Smith to the neoclassicals have celebrated the magic of free markets. Yet when I was a graduate student much of the work of economists grappled with market failures, not successes. Failures of poverty and income distribution, of associated maladies such as crime, depression and poor health. Failures of pollution and environmental degradation. Failures of monopoly, oligopoly, and of excessive concentrations of industry power. These were often labeled “externalities”: unfortunate leakages from an otherwise closed, elegant, competitive system. Indeed, the market ideal was sanctified as “perfect competition.” The solutions to the external leakages from this perfection invariably involved some sort of government intervention.

The economists were right: markets can’t solve all problems, and market failures must be recognized and addressed. Impact investing risks being a utopian project if it is not conditioned and supported by effective public policy. The US needs to join all other major nations by underwriting a baseline of progressive taxation, living wages, affordable universal health care and secure housing. Basic research on renewable energy and disease prevention, as well as investments in energy-efficient public transportation are areas where public impact investments are sorely needed. “Too big to fail” institutions must be broken up, decreasing their political and market power, and reducing socialized risks. Money energy must no longer be allowed to corrupt and distort politics. And we must join the world in setting an honest environmental price on greenhouse gas emissions. Given our history and current challenges, we must do these things through the lens of racial and economic justice. I am encouraged that these necessary changes are at least being discussed during the current political cycle in the United States.

Finally, the system cannot and will not reform itself from within. As interest in impact investing grows, it is becoming the next business line in mega-financial companies. Goldman Sachs just bought a leading provider of impact investing research. The firm Mitt Romney founded, Bain Capital, is starting an impact investing fund. These are reactive attempts to co-opt the next big thing, with little influence on an oligopolistic, lucrative superstructure. I seriously doubt that the infection will transform the host. We need to keep nurturing and growing authentic alternatives from outside the broken but still-dominant money infrastructure.

Each of these five people is my brilliant colleague, my trusted partner, my dear friend.

All provided helpful comments on earlier drafts.

Christina Rappich, Eric Poettschacher, Farnum Brown, Jane Settree-Seitchik,

Natasha Lamb: thank you, with blessings of gratitude. – Adam

Adam Seitchik was until 2013 the Chief Investment Officer of Arjuna Capital. Their investment professionals are widely regarded as some of the most experienced and skilled analysts in the entire field of sustainable and responsible investing, particularly when it comes to the burgeoning discipline of ESG (environmental, social and governance) risk and opportunity analysis.

OMG, Adam this is magnificent work all around. It is amazing because it is thought provoking, readable and understandable to the average reader. It doesn’t require a business degree or several courses in economics for one to grasp this concept of money energy. It’s interesting, exciting and totally digestible. I actually enjoyed it because it was written so well in a easy – no jargon or economic lingo–to comprehend style. I absolutely appreciate you distributing this. I’m sending it to some friends, if you don’t mind. We’ll discuss it at our book club. BTW I liked the drawings as well. Kudos! –

Thank you, Adam. I really appreciated this. How many books have you written? I would like to read other such writing that is not academic nor geared to only economic geeks. I’m very excited. It’s a great way to get into another discussion that isn’t just about capitalism and its negative influences. Whew, such a treat!

Thanks Marti! I have written a number of short pieces. Books were a long time ago, when I was a labor economists. Some of my writing is archived here:

http://www.sirc.us/Research_Publications.html

This is really good. Having read “The Big Short” and “Flash Boys” I had a lot to complain about but not much to hope for. Thanks for providing the perspective on free market economics as a way of thinking that faces the same challenges as any other human intellectual enterprise – incompleteness in explanatory power. I have to spend more time thinking on this before I can respond fully.

Great work, dude.

Ken, that is a good point about human models always being limited by the underlying assumptions. I’ve found in economics that often the limitations are forgotten over time, leaving us with an uncritical sanctification of the model itself.

Adam,

This is beautifully written and makes the case clearly.

Thanks for sharing.

There seems to be a growing awareness that the way we’re doing things simply isn’t working. In the very first place, we are destroying the natural environment that supports human society. It is heartening to hear so many different people from so many different standpoints devoting their considerable energies to making needed changes. We need the efforts of people like Adam in the investment community, scientists like James Hansen battling against climate catastrophe, entrepreneurs like Elon Musk, economists like Joseph Stiglitz, political activists, politicians, etc. This may be the most challenging and dangerous moment in human history, and we desperately need change makers.

Adam:

Kudos on this thoughtful and well-articulated piece, which is equally personally and professionally challenging. Tracing your own journey and the evolution of your perspective from family through academia to your “mercenary period” onward to today was so insightful — particularly as your colleague and (hopefully) peer.

Thanks for your investment of time, effort, and (of course) energy in this important piece and broader practice.

-david